Return of allotment by unlimited company allotting new class of shares. Companies Act 2013 incorporated therein forms allotment of shares that are listed on NSE and BSE or any other stock exchanges in India.

Tarsons Products Ipo Shares Allotment Status Is Out Now Initial Public Offering Status Allotment

When it is required.

. If shares were allotted over a period of time complete To Date both from date and to date boxes. What is a Statement of Capital. Yes all Return of Allotment of Shares ROA occurring after 31 January 2017 must be lodged online MyCoID 2016.

Issue new shares in the company after it has been registered. Private companies can allot new shares only after filling the Return of Allotment of Shares. If the company has period for the date of allotment the date of lodgement of the.

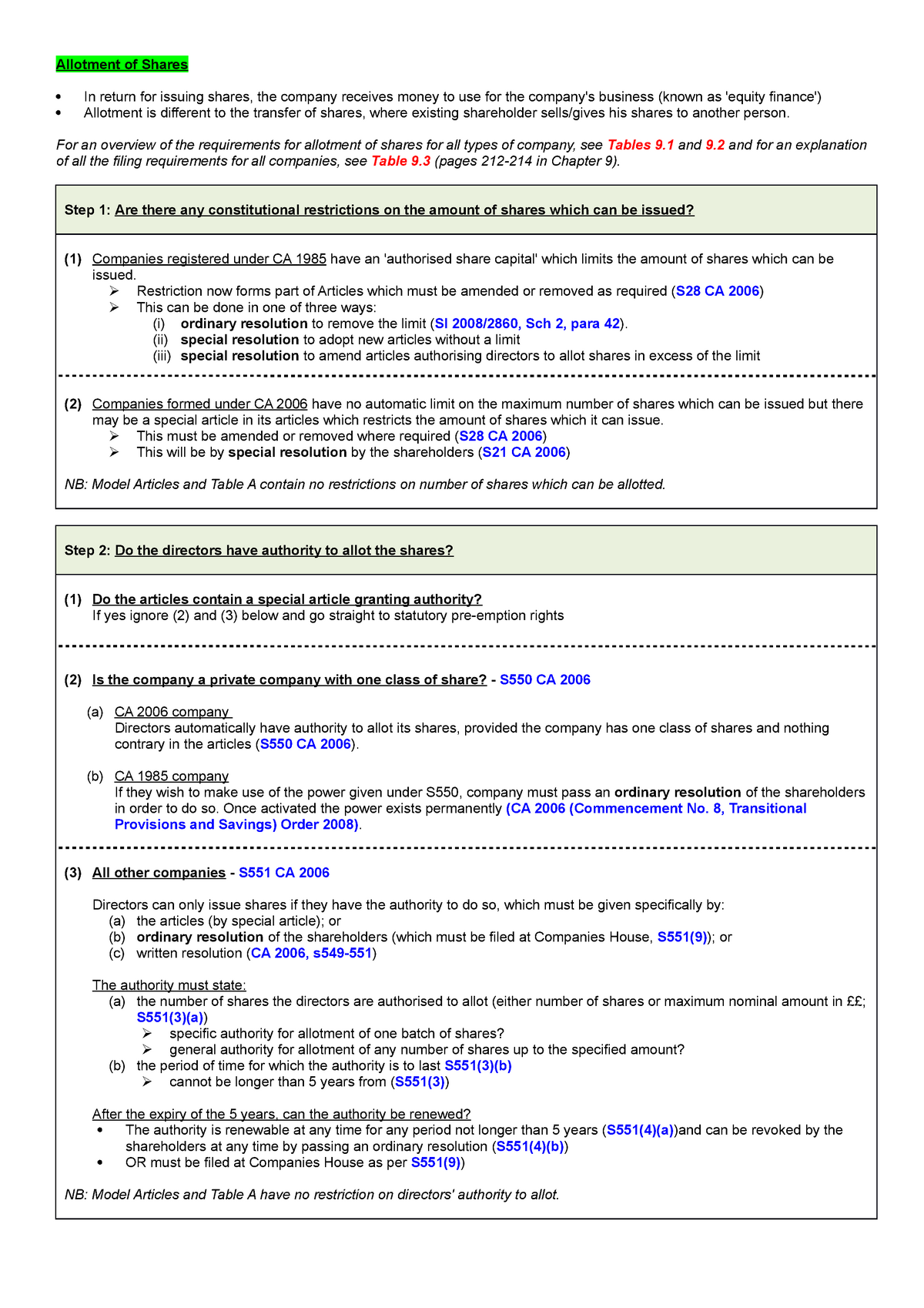

Updated list of shareholders and their shareholdings. A Return of Allotment also known as the SH01 form must be completed if you decide to allot ie. The process of appropriation of a certain number of shares and distribution among those who have submitted the return applications of shares is known as allotment of shares.

SH01 return of allotment of shares PDF 562 KB 10 pages Details This form can be used to give notice of shares allotted following incorporation. It shall also state the consideration of allotment and whether the shares are fully or partly paid up. QUANTEXA LIMITED Company Number.

Ii Issuance of shares through private placement in this case the firm should a return of allotment in form PAS-3 within 15 days of allotment or. 10045407 Received for filing in Electronic Format on the15072021 XA8S7A9T Shares Allotted including bonus shares Date or period during which shares are allotted From To 09072021 13072021 Class of Shares. UK Company Formation Registrations Companies MadeSimple.

Class of shares that are being issued. Shares can be allotted for cash or consideration other. Amount if any unpaid on each share.

Number of shares allotted. If youve already incorporated a company youll know that allocating shares and naming shareholders is part of this process. Reasons for Allotment of Shares.

If the company has period for the date of allotment what is the date used for the calculation of late lodgement. Form 24 Return of Allotment of Shares Form 24 is used to allot new shares to shareholders of a sdn bhd company. To complete a return of allotment of shares form SH01 you should enter the date of allotment for the cash shares.

RETURN OF ALLOTMENT OF SHARES Number of shares allotted payable in cash. To add allotted shares enter details of the shares - including the currency. Offence of failure to make return.

Youll only need to file an SH01 if you allocate new shares after incorporation. It is a statement that includes the details of the shareholders and the allocated shares which are subjected to submission to the Registrar with an accented form from the Directors of the company. Allotment Dates Allotment date If all shares were allotted on the From Date same day enter that date in the from date box.

It takes longer to process paper forms sent to us. While allotting bonus shares the return should state the names addresses and occupations of the allottee in addition to the number and nominal amount of the shares constituted in allotment together with a copy of the resolution authorising the issues of such shares. Shares allotted Please give details of the shares allotted Class of shares Eg.

You can add an end date to create a period of allotment. Return of allotment by limited company. Technically with a SH01 form which contains the whereabouts of the shareholders and the details of the share and is filed with the registrar of companies within 30 days.

The form needs to be submitted to SSM for registration once the allotment were approved by the directors existing shareholders. This form must be signed by a director or secretary and filed with Companies House within 30. It is to be done within 30 days of shares allotment by filing an e-form PAS 3.

While public companies are free to allot new shares anytime but they also have to fill the Return of Allotment of Shares transaction within 14 days of allotment. According to section 142 of the Companies Ordinance the return shall include the statement of capital name and address of each allottee. What is return of allotment.

The total number of issued shares of the company. Provisions about allotment not applicable to shares taken on formation. Return of Allotment of Shares Company Name.

The form is titled Return of allotment of shares and youd need to file this form to give notice about shares issued after incorporation. When shares are allotted. Return of allotment of shares is the process of adding new shares into a company.

Amount paid if any or deemed to be paid on the allotment of each share. Number of shares allotted for consideration other than cash. Submit copy of contract in writing relating to the allotment including particulars of the valuation of the consideration.

Before filing the Return of Allotment of Shares for your company you will need to prepare the following information. I Issuance of shares to the general public in this case the firm should file a return of allotment of shares with the Registrar within 30 days in form PAS-3. Amount paid or due and payable on each share.

What Is The Return Of Allotment Of Shares Adding New Shares

How Do I Enter The Details Of Any Non Cash Consideration During The Allotment Process Inform Direct Support

14 Allotment Of Shares Allotment Of Shares In Return For Issuing Shares The Company Receives Studocu

Share Allotment Document Seller Verification Amazon Seller Forums

Bogus Share Capital Discharge Of Onus Law On Not Giving Cross Examination Http Taxguru In Income Tax Bogus Share Capital Dis Indirect Tax Income Tax Law

Know All About Mca E Form Pas 6 For Unlisted Public Companies Public Company Secretarial Services Mca

Return Of Allotment Of Shares Sh01c Gov Uk

Pin By Bdi Hk Limited On Company Secretarial Services Secretarial Services Memorandum Secretary

What Is The Difference Between The Issuing Of Shares And The Allotment Of Shares Quora

Pas 3 Form Return Of Allotment Learn By Quickolearn By Quicko

Form 24 Return Of Allotment Of Shares Pdf

How To Invest In Digital Gold Through A Mutual Fund Investing Mutuals Funds Fund Management

Omtex Classes Regret Letter Lettering Regrets Rejection

Sh09 Return Of Allotment By An Unlimited Company Allotting A New Class Of Shares Section 556

Omtex Classes Regret Letter Lettering Regrets Rejection

Form 24 Return Of Allotment Of Shares Pdf Government Justice